Cabell County Personal Property Tax - Search our database of free huntington residential property records including owner names, property tax assessments & payments, rates & bills, sales & transfer history, deeds, mortgages, parcel, land, zoning & structural descriptions, valuations & more. One of my main goals is to find ways to offer online data, services, and forms to the citizens of cabell county, our local business community, and those that will potentially do business here. These maps are available for review and may be purchased at the assessor's office. I hope you find this information to be accurate, helpful, and easy to navigate. Establish and maintain a set of tax maps. Audit entities doing business in the county and values all taxable personal property. One of my main goals is to find ways to offer online data, services, and forms to the citizens of cabell county, our local business community, and those that will potentially do business here.

Search our database of free huntington residential property records including owner names, property tax assessments & payments, rates & bills, sales & transfer history, deeds, mortgages, parcel, land, zoning & structural descriptions, valuations & more. One of my main goals is to find ways to offer online data, services, and forms to the citizens of cabell county, our local business community, and those that will potentially do business here.

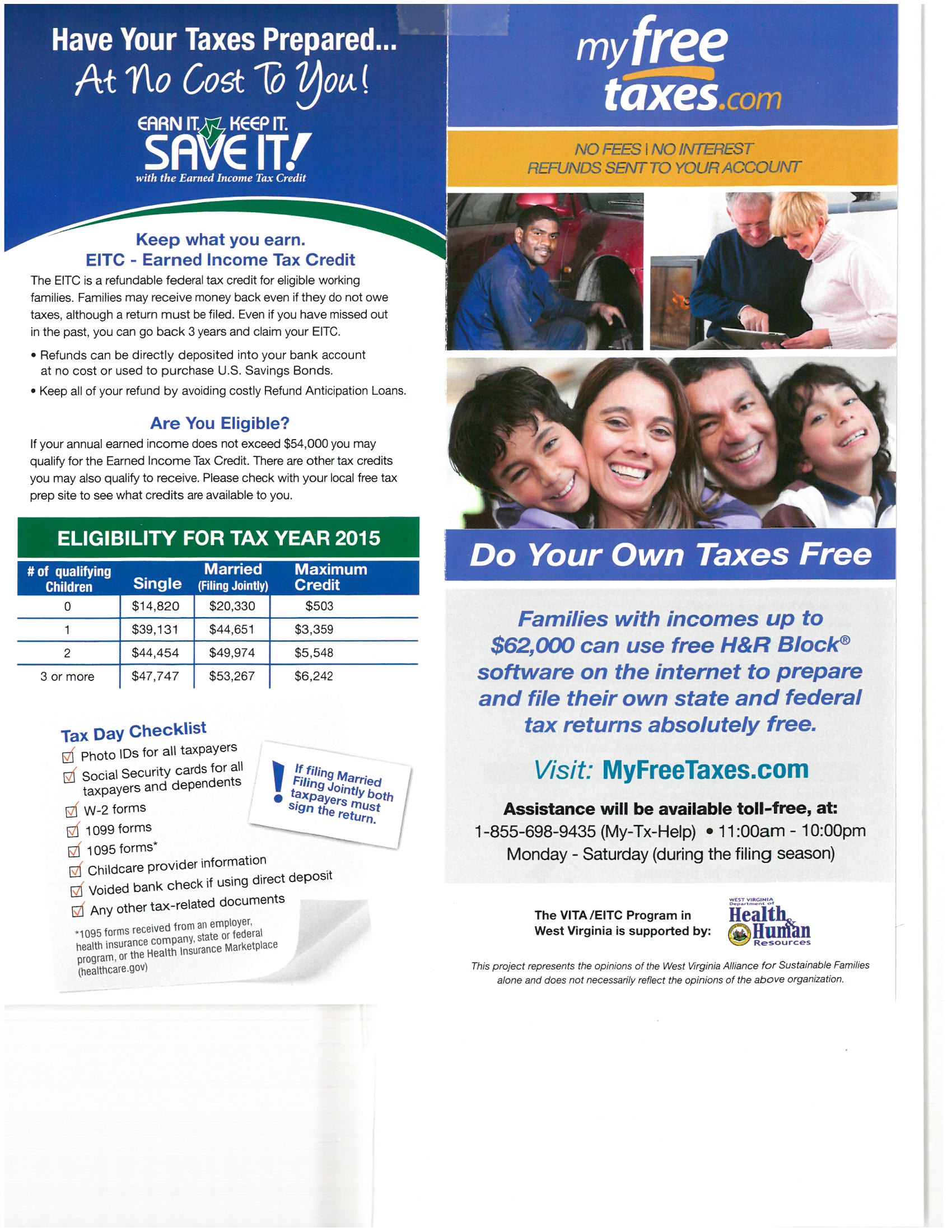

All valuations must occur on a fiscal year basis commencing on the first day of july. Of their real and personal property each year. Payments may be made to the county tax collector or treasurer instead of the assessor. The specific duties of the assessor are to discover, list and value all real and personal property located within the boundaries of the county on an annual basis. Audit entities doing business in the county and values all taxable personal property. One of my main goals is to find ways to offer online data, services, and forms to the citizens of cabell county, our local business community, and those that will potentially do business here. The annual assessment of property you owned on july 1 is now required. I hope you find this information to be accurate, helpful, and easy to navigate. Cabell county real and personal property assessment report for tax year 2025 for property owned on july 1, 2023. Establish and maintain a set of tax maps.

They issue yearly tax bills to all property owners in cabell county, and work with the sheriff's office to foreclose on properties with delinquent taxes. Payments may be made to the county tax collector or treasurer instead of the assessor. Property tax information for cabell county, west virginia, including average cabell county property tax rates and a property tax calculator. The annual assessment of property you owned on july 1 is now required. Of their real and personal property each year. Review the information shown, make applicable changes, sign and return it no later than october 1. Online tax record search enter a search argument, and select the search button pay your taxes online

How Old Is Dana Perino Husband One Story Homes For Sale In Windrose Spring Tx 16 Conway Cahill Brodeur